Don't just acquire customers.Keep them.

Go from activation to funding. Fast.

Are you aligned with the Customer Spending Loop?

EASY ONBOARDING

Get customers signed up for your app in a snap and increase your overall activation rate.

INSTANT DIGITAL ISSUING

Don’t lose customers over the wait time for a physical card. Deliver a virtual debit card directly to their mobile wallet.

FAST ACCOUNT FUNDING

Empower spending with instant account funding that lets them use their virtual card right away.

DIRECT DEPOSIT + EARLY ACCESS

Enable customers to easily set up direct deposit—and even access their wages early.

REWARDS ALL AROUND

Encourage spending and drive revenue with rewards like cash-back bonuses and card upgrades as you gain actionable data on customer behavior and preferences.

SPECIAL SERVICES

Go above and beyond with peer-to-peer transfers and bill-pay tools that simplify customers’ lives and improve your bottom line.

EXTRA CREDIT

Earn a central role in customers’ financial lives with services like overdraft protection, loans and secured credit.

FRAUD PREVENTION

Offer robust safeguards that inspire trust, enhance peace of mind, improve confidence and drive long-term loyalty.

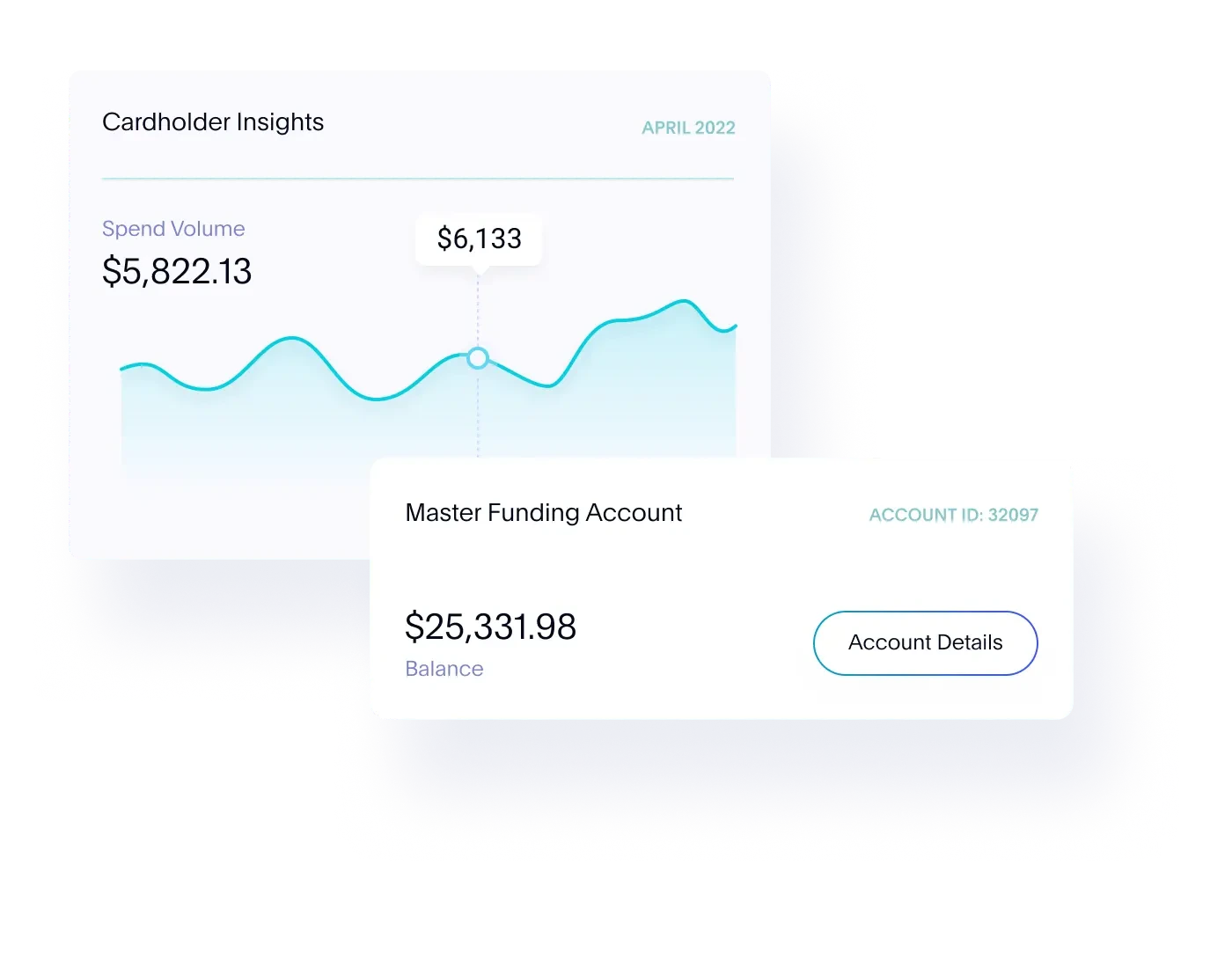

INSIGHTS YOU CAN ACT ON

The more engaged your customers are, the more data you’ll have to help you fine-tune your offerings—which will engage even more customers.

How to optimize customer retention + boost spending rate.

This playbook provides business leaders a path through the four stages of the activation challenge and the customer lifecycles, which include:

- Onboarding: Connect the customer to their account, quickly

- Activation: Getting customers to spend

- Growth and Value Add: Extending customers’ buying power

- Marketing: Keeping customers aware through an omni-channel approach

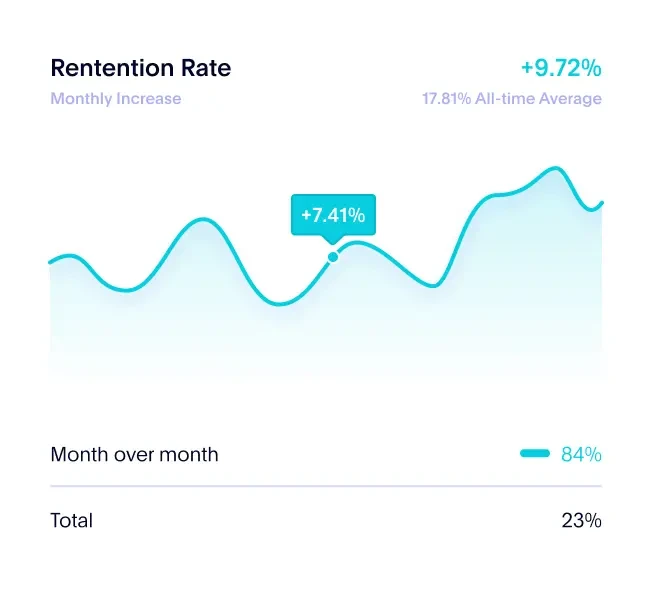

23%

ISSUE VIRTUAL CARDS

Programs that issue virtual cards right away, while physical cards are enroute, boost transaction volume by 23% on average.

84%

DOUBLE LIFETIME VALUE

Our client data shows spend increases on the card by 156% for accounts with Early Pay access, which boosts the lifetime value of a customer by nearly 84%.

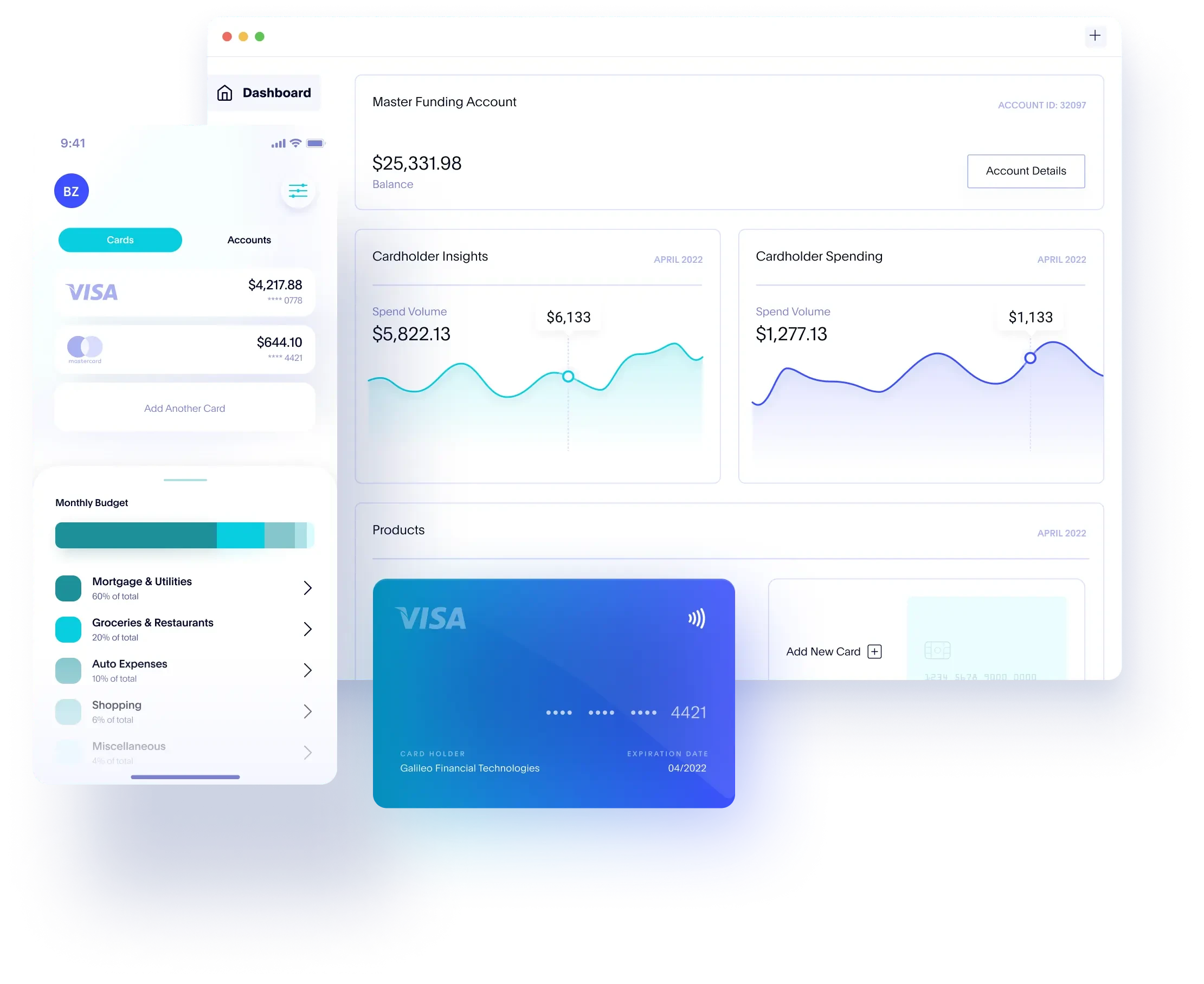

One platform, tailored experiences.

Build customized financial reports and share business analytics across your organization to enhance visibility, analysis and decision-making capabilities that accelerate your growth.

Our in-house expertise and simplified integrations will set your card issuing process up for success from the start.

Improve your customer experience with a myriad of deposit options like direct deposit, early pay, round-up and overdraft capabilities.

Improving onboarding and retention.

• Between account creation and activation

• Between activation and depositing funds into the account

With these engagement points in mind, Galileo has developed products and features to guide your customers through the process so that they can activate, fund, and start spending from a new account as quickly as possible.