Stay ahead of fraud with real-time risk intelligence.

Online payment fraud losses alone are estimated to exceed $362 billion over the next five years. This can damage your reputation and cut deep into your bottom line. Don’t get caught off guard.

AI models.

Our AI machine learning models go beyond a rules engine, continuously adapting to detect emerging fraud patterns and monitor every transaction in real time.

Transaction monitoring.

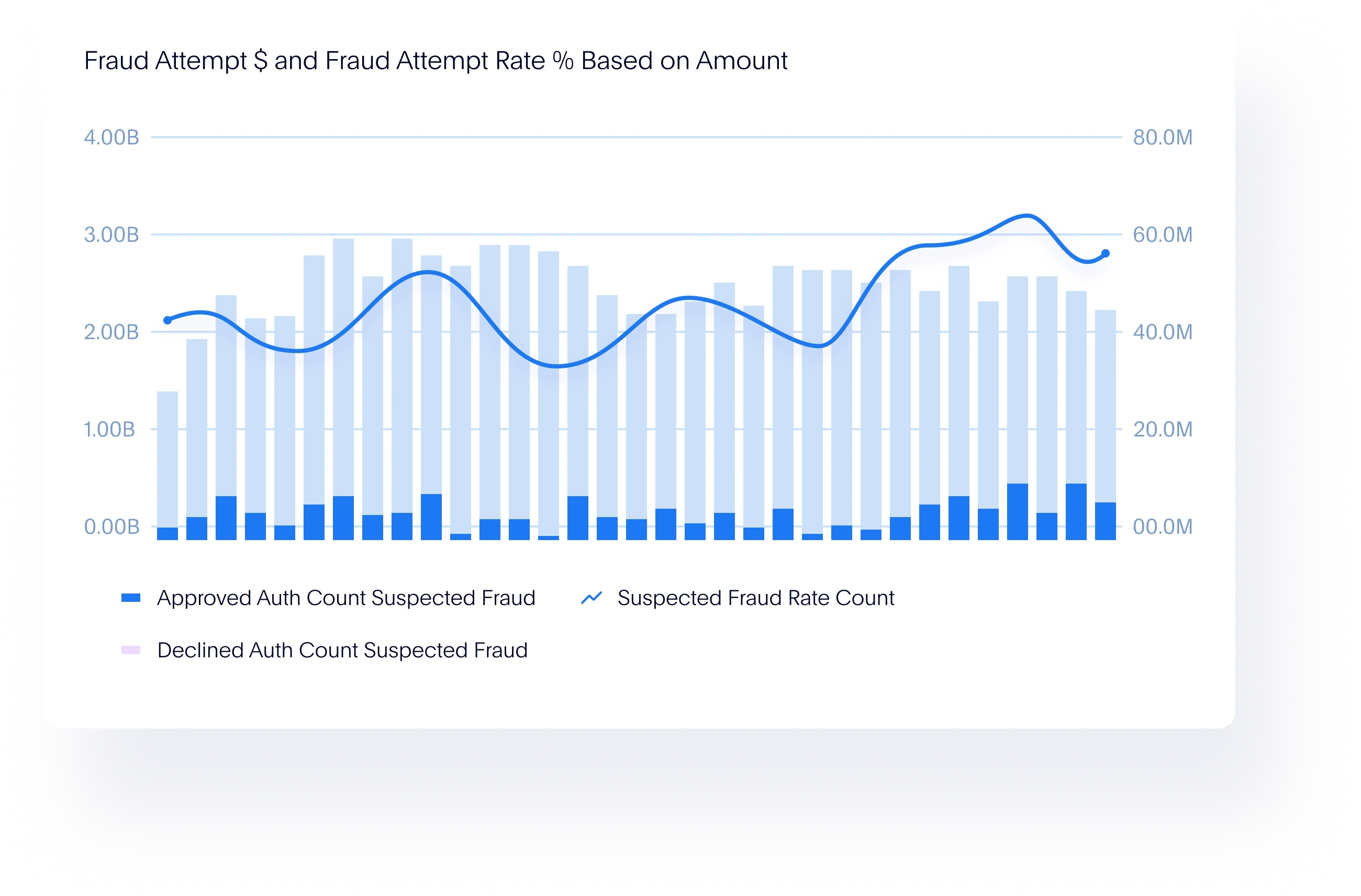

Real-time and near real-time fraud monitoring which combines machine learning, rules, analytics and models designed to proactively react to fraud signals.

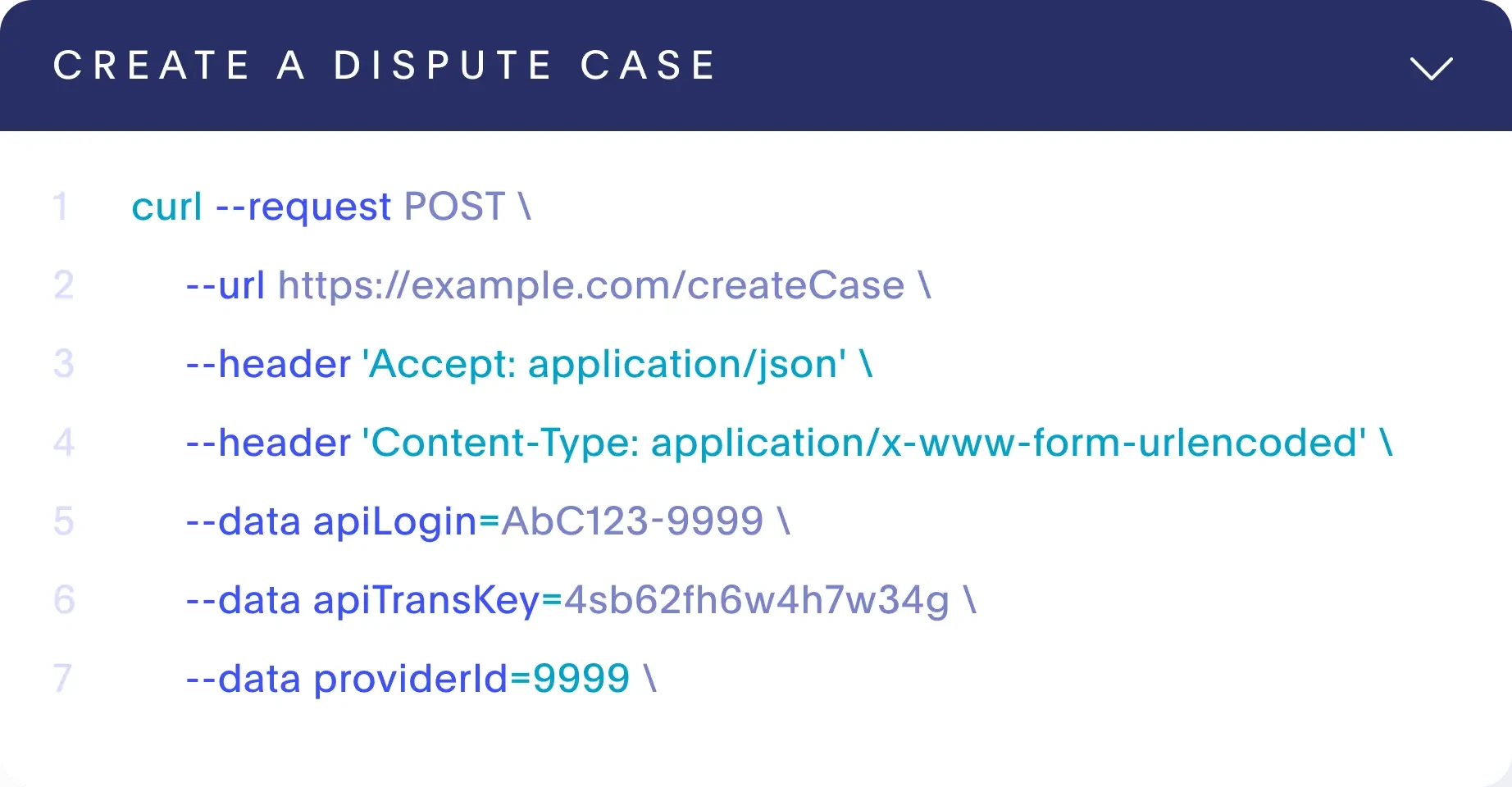

Dispute tracking.

Using our internally developed Dispute Tracker, we monitor your disputes to support taking appropriate actions within required timeframes.

Galileo’s Risk and Compliance platform protects you and your customers from hidden risks.

Our fraud prevention and detection products defend your program from card-present and card-not-present fraud by applying proactive and reactive tools to protect your customers and your bottom line.

Our solution integrates machine learning-driven insights, real-time data monitoring, and customizable rules engines to keep your payments secure.

We offer a suite of fraud management solutions to secure all your transactions and a wide range of services to mitigate program losses due to fraud while ensuring a frictionless transaction experience for your customers.

Fraud policy management, on your terms.

Mitigate your risk with enhanced identity verification.

- Dynamic fraud decisioning to detect threats before they happen.

- AI-powered risk scoring leveraging over 130 million unique spending patterns.

- Network risk intelligence for enhanced fraud detection across multiple channels.

Secure transactions - address fraud risks in real-time before they escalate.

- Instant transaction risk assessment across credit, debit, ACH, BNPL, and more.

- Seamless API integration for real-time decision-making.

- Automated fraud dashboards with advanced data analytics.

Spot fraud patterns with dispute tracking.

Key benefits:

- 35% reduction in fraudulent transactions.

- 15% decrease in dispute handling costs.

- Real-time fraud analytics for smarter decision-making.

Fraud prevention that works for you.

Whether you're tackling fraud in credit cards, ACH, BNPL, or instant payments, Galileo provides the tools you need to detect, prevent, and mitigate financial crime before it impacts your bottom line.