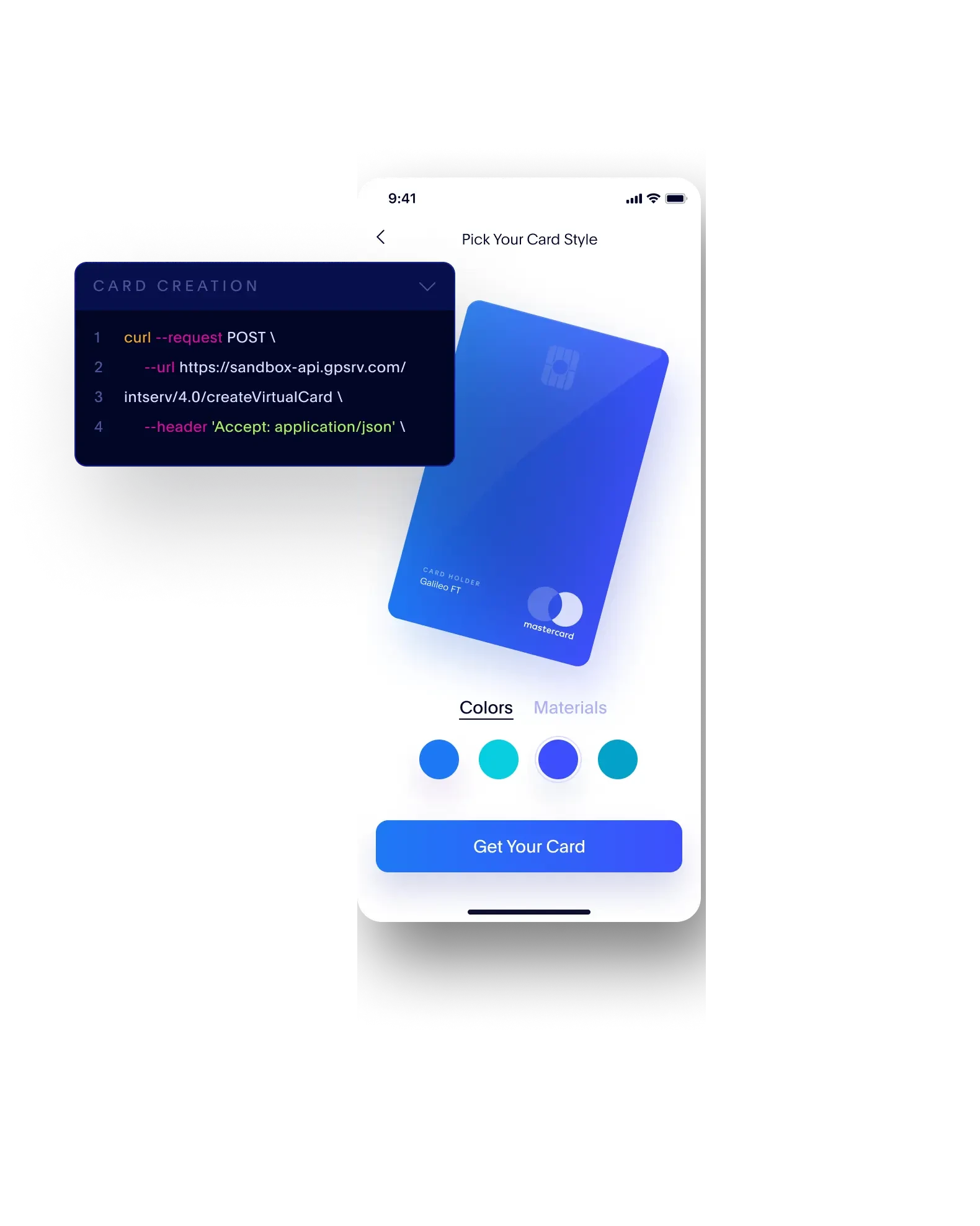

TODAY'S INNOVATORS ARE TAPPING INTO THE POWER OF GALILEO'S OPEN API TECHNOLOGY

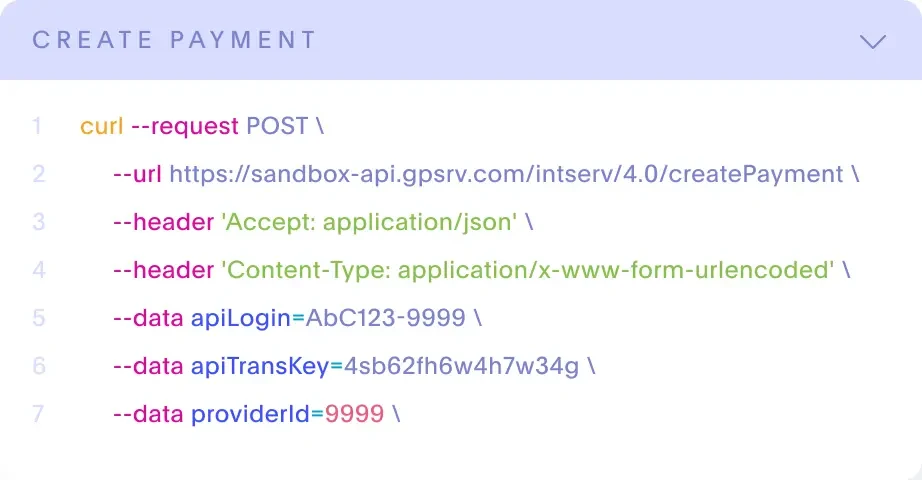

Explore our developer docs.

Integrate the dispute process into your app or website to provide a seamless dispute experience.

Participate in the decisioning for approving and denying bill payments and ACH debits.

Below-the-glass innovation drives above-the-glass experiences.

01. FINTECH ECOSYSTEM

55+ partner banks, networks and embossers store and transmit financial data.

02. OPEN API TECHNOLOGY

Galileo's APIs complete the requested activity below the glass.

03. YOUR CUSTOMER API

Requested activity completes and your customer is notified above the glass.

B2B PAYMENTS & EMBEDDED FINANCE

FIs are increasingly tapping APIs for next gen banking & finance.

APIs help streamline B2B payments, leading more financial institutions to look to the technology when developing innovative new products or offerings.

Source: Biztech Magazine, Why API Powered Open Banking Future Finance

90%

BOOST REVENUES

Banks or financial services companies that plan to utilize APIs to boost revenues in the coming year.

75%

CUSTOMER CONVERSION

Plan to rely on the technology to help them drive customer conversion.

DISCOVER OUR PLATFORM

Start building the future of finance

Get a feel for our APIs without cost or security risk, using your own tools or our Postman collection. You’ll soon be creating accounts, moving money, and simulating transactions in our Sandbox environment, just like real-world operations.