DEPOSITS

Improve your customer experience with a full suite of deposit options.

From direct deposit to round-up savings, consumers and businesses expect seamless, secure, and flexible money management. Whether you're a bank expanding deposits or a fintech enhancing financial tools, Galileo provides the infrastructure to optimize deposits and deepen relationships.

The number of accounts on the Galileo platform—and growing.

Customers expect more. Deliver more.

New research from the Galileo Consumer Banking Report reveals that nearly half of all new checking accounts in the U.S. were opened with digital banks and fintechs in the past year. Consumers are curating their own financial ecosystems, keeping funds across multiple accounts to maximize returns, improve convenience, and access better digital experiences.

Banks and fintechs that fail to evolve risk losing deposits—not just to digital challengers, but to their own customers seeking better options elsewhere. To remain their primary financial provider, you must offer the right products at the right time.

Banks and fintechs that fail to evolve risk losing deposits—not just to digital challengers, but to their own customers seeking better options elsewhere. To remain their primary financial provider, you must offer the right products at the right time.

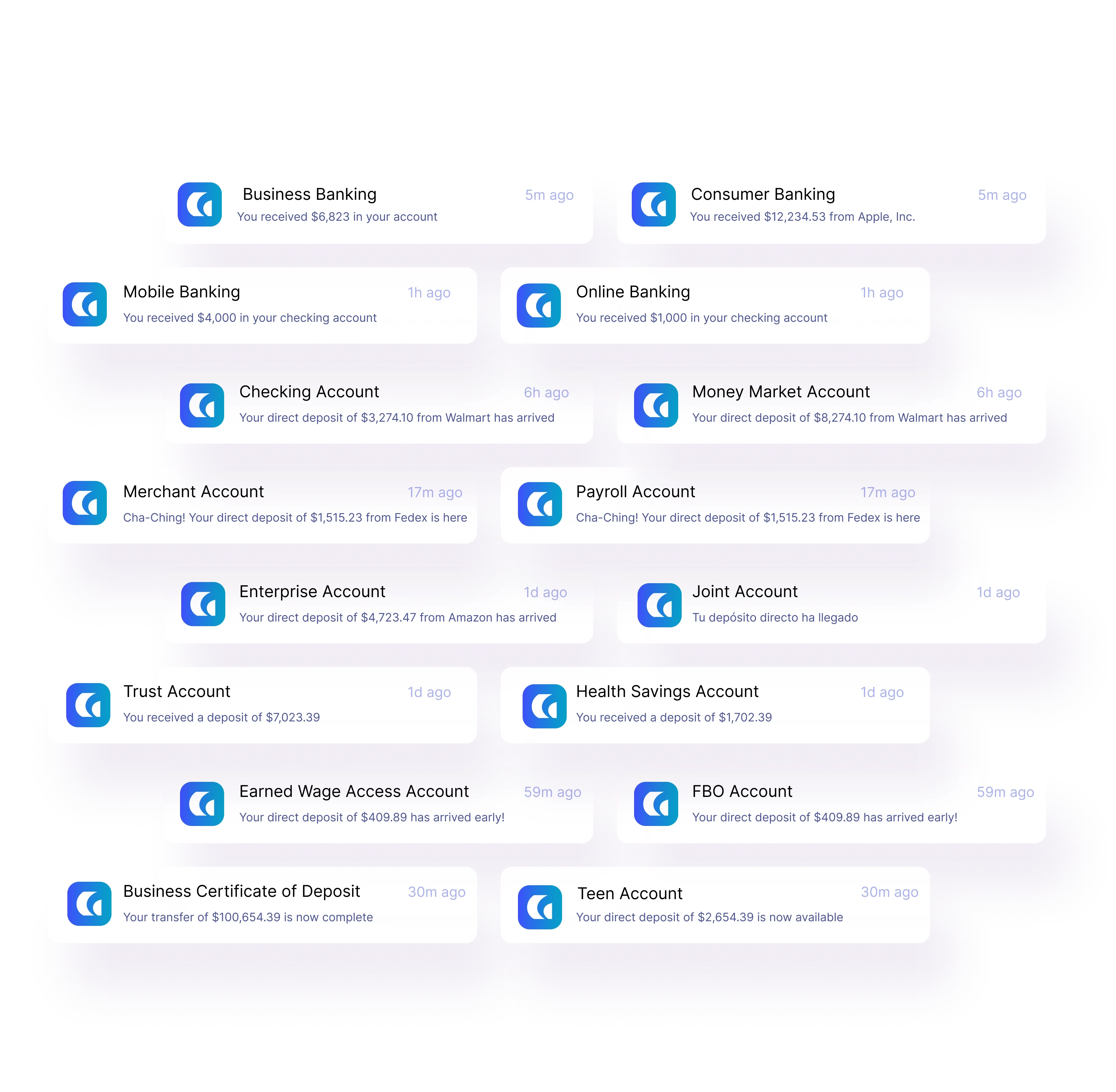

Direct Deposit

Boost profitability with direct deposit.

Paper checks are slow, inconvenient, and insecure. Customers don't want to wait for checks to clear—they expect instant access to their earnings. With direct deposit capabilities for both consumers and businesses, Galileo enables fast, secure, and frictionless fund transfers through ACH, early paycheck access, and mobile deposits.

Make onboarding seamless and increase retention with direct deposit switch, which allows customers to set up deposits without HR involvement or paperwork—removing barriers and accelerating adoption.

Make onboarding seamless and increase retention with direct deposit switch, which allows customers to set up deposits without HR involvement or paperwork—removing barriers and accelerating adoption.

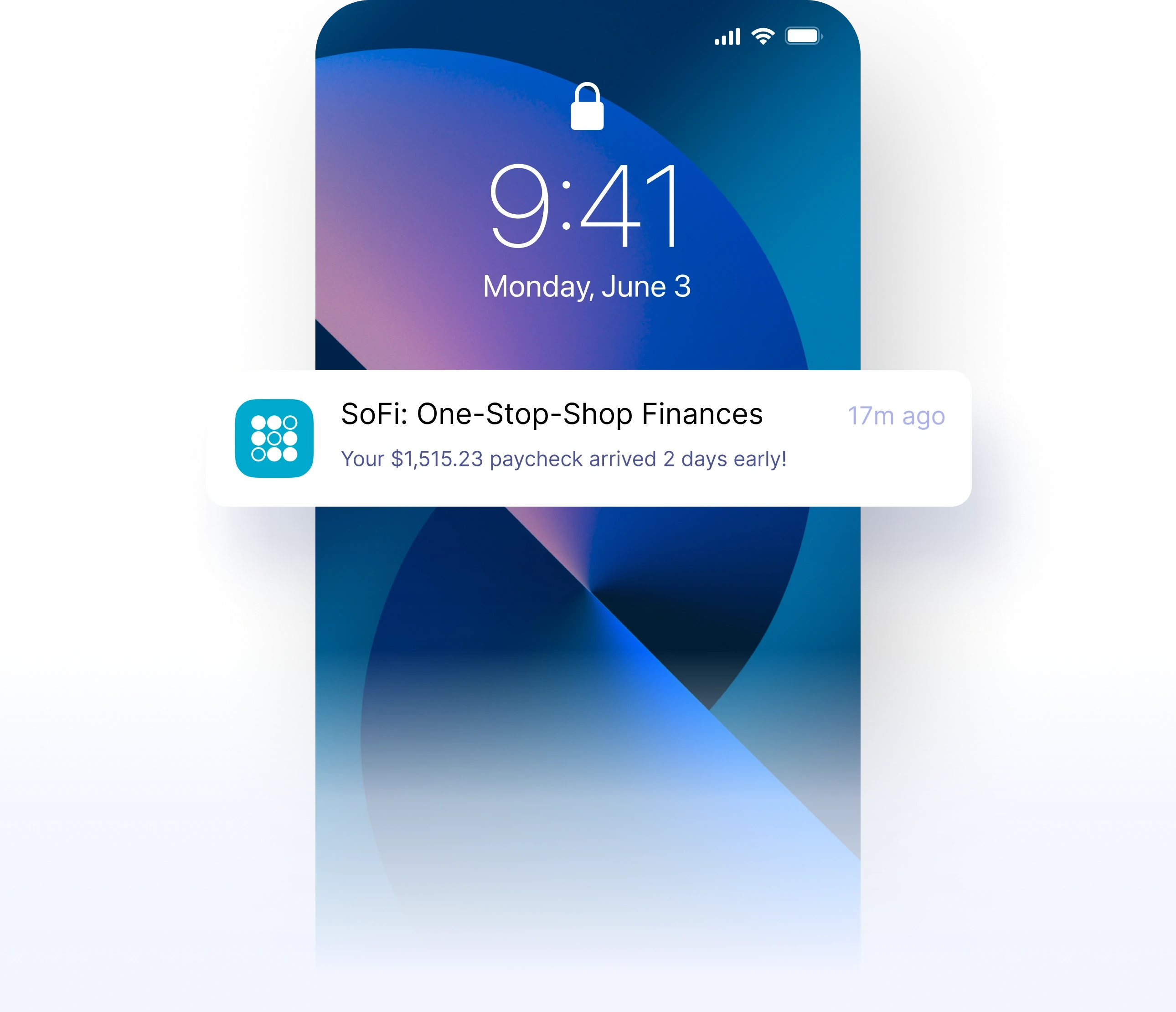

Early Pay

Help customers access their pay sooner.

Many consumers live paycheck to paycheck—waiting for funds to clear shouldn’t be another financial stressor. Early Pay gives customers access to their earnings as soon as their employer deposits funds—often days before payday.

This feature strengthens deposit relationships, increases engagement, and improves customer financial stability—all while positioning your institution as a trusted financial partner.

This feature strengthens deposit relationships, increases engagement, and improves customer financial stability—all while positioning your institution as a trusted financial partner.

Round-Up Savings

Help customers save effortlessly.

Small savings add up. With round-up capabilities, customers can automatically save or invest their spare change—making money management simple and rewarding.

- Purchases are rounded up to the nearest dollar.

- Extra cents are transferred into a savings, investment, or charitable account.

- Set it and forget it—building better savings habits effortlessly.

- Purchases are rounded up to the nearest dollar.

- Extra cents are transferred into a savings, investment, or charitable account.

- Set it and forget it—building better savings habits effortlessly.

Round up savings $0.13

Overdraft protection

Prevent declined transactions and protect customers.

Give customers peace of mind with overdraft protection that ensures transactions go through when funds are temporarily low.

Galileo’s overdraft solution is fully configurable, allowing you to:

- Set flexible fee structures

- Offer grace periods to keep customers in good standing

- Customize overdraft limits based on account history

Galileo’s overdraft solution is fully configurable, allowing you to:

- Set flexible fee structures

- Offer grace periods to keep customers in good standing

- Customize overdraft limits based on account history

Deposit Sweep

Maximize account holder value and liquidity.

For banks and financial institutions, sweep accounts optimize cash balances by automatically distributing excess funds across multiple accounts—maximizing yield while maintaining liquidity and FDIC insurance coverage.

Galileo partners with InfraFi to enable Deposit Sweep, helping institutions optimize treasury management and customer deposits.

Galileo partners with InfraFi to enable Deposit Sweep, helping institutions optimize treasury management and customer deposits.

global/CTA3D.webmglobal/CTA3D.mp4

Loading...