NEXT-GEN Digital BANKING

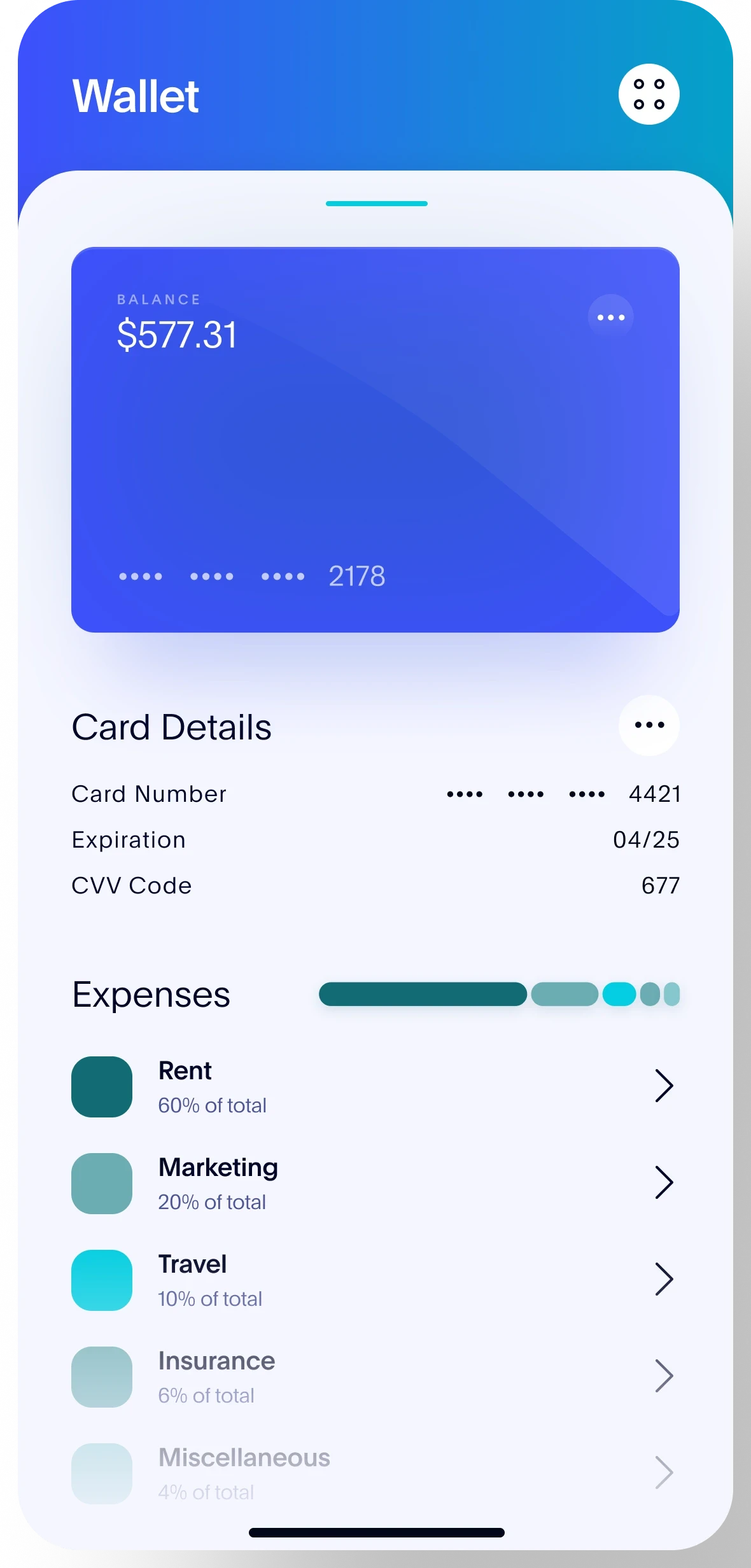

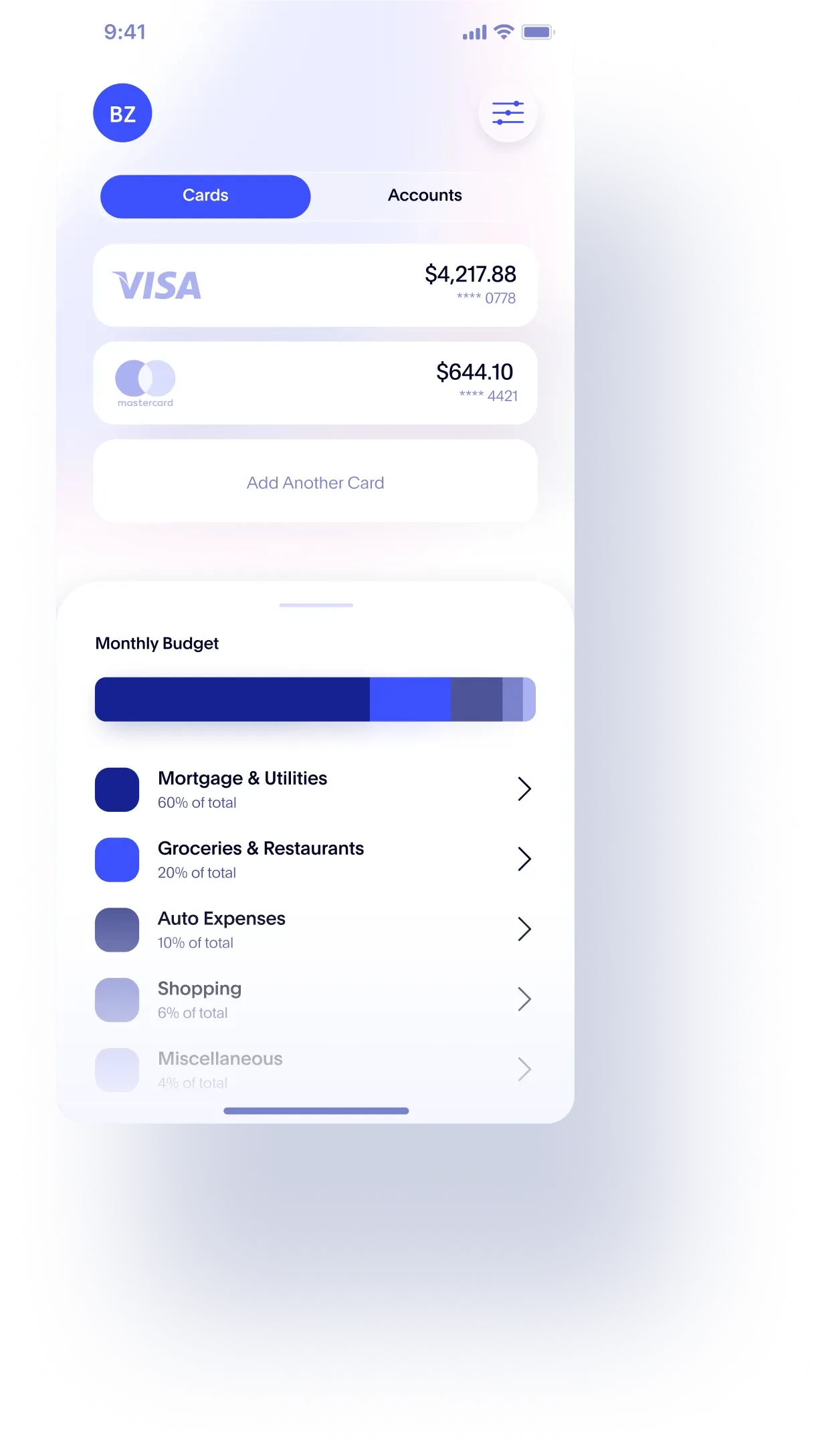

Mobile and web UX experiences for your customers.

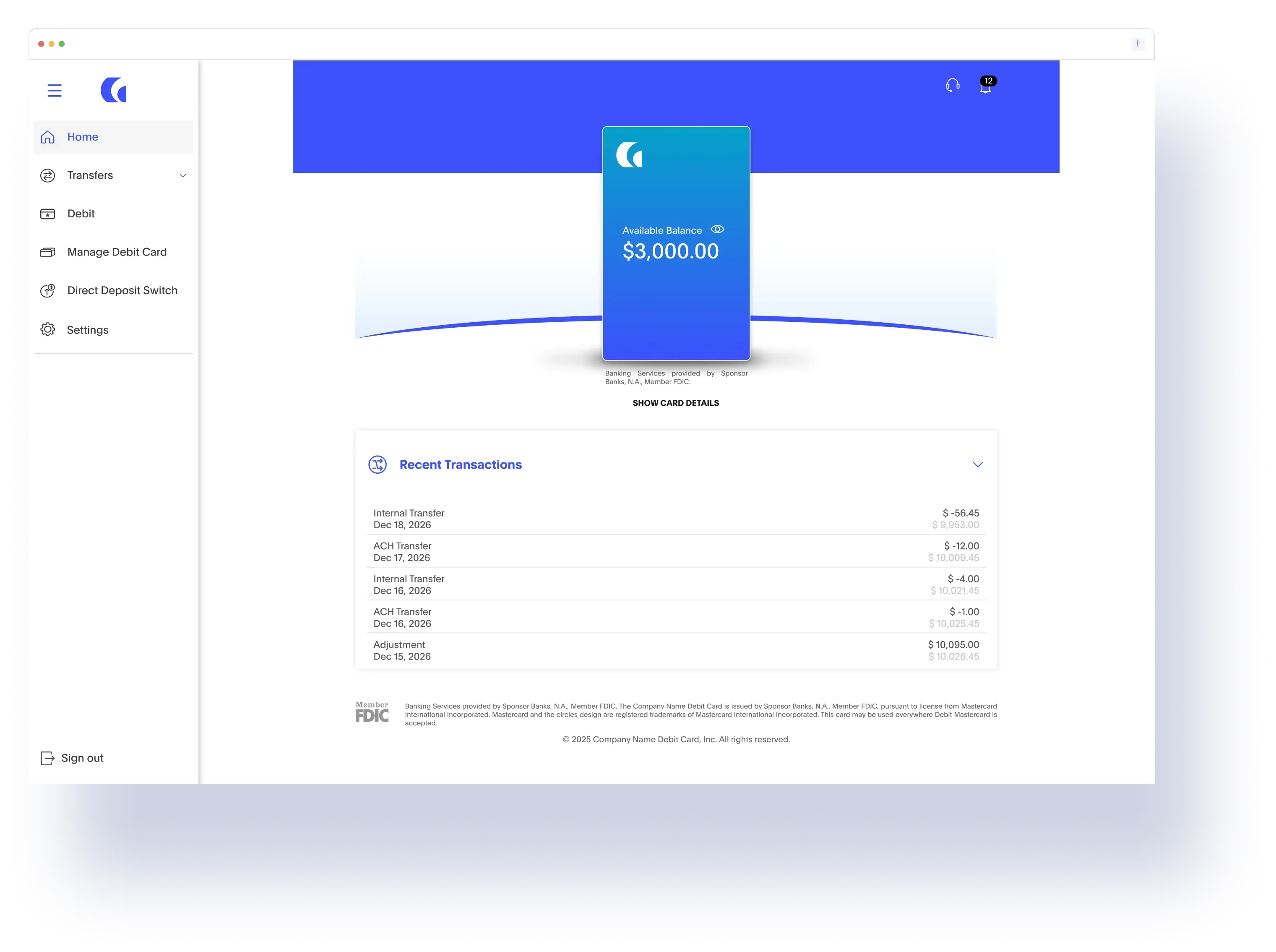

Enable modern, user-friendly customer interactions through web and mobile channels. It prioritizes customer-centric design, allowing you to deliver an enhanced multichannel experience with seamless transitions between mobile, web, and in-branch banking.

- Microservices-driven architecture

- Modular and scalable

- Real-time data processing

- Industry-leading security

Cyberbank Digital helps you differentiate with:

Structural flexibility

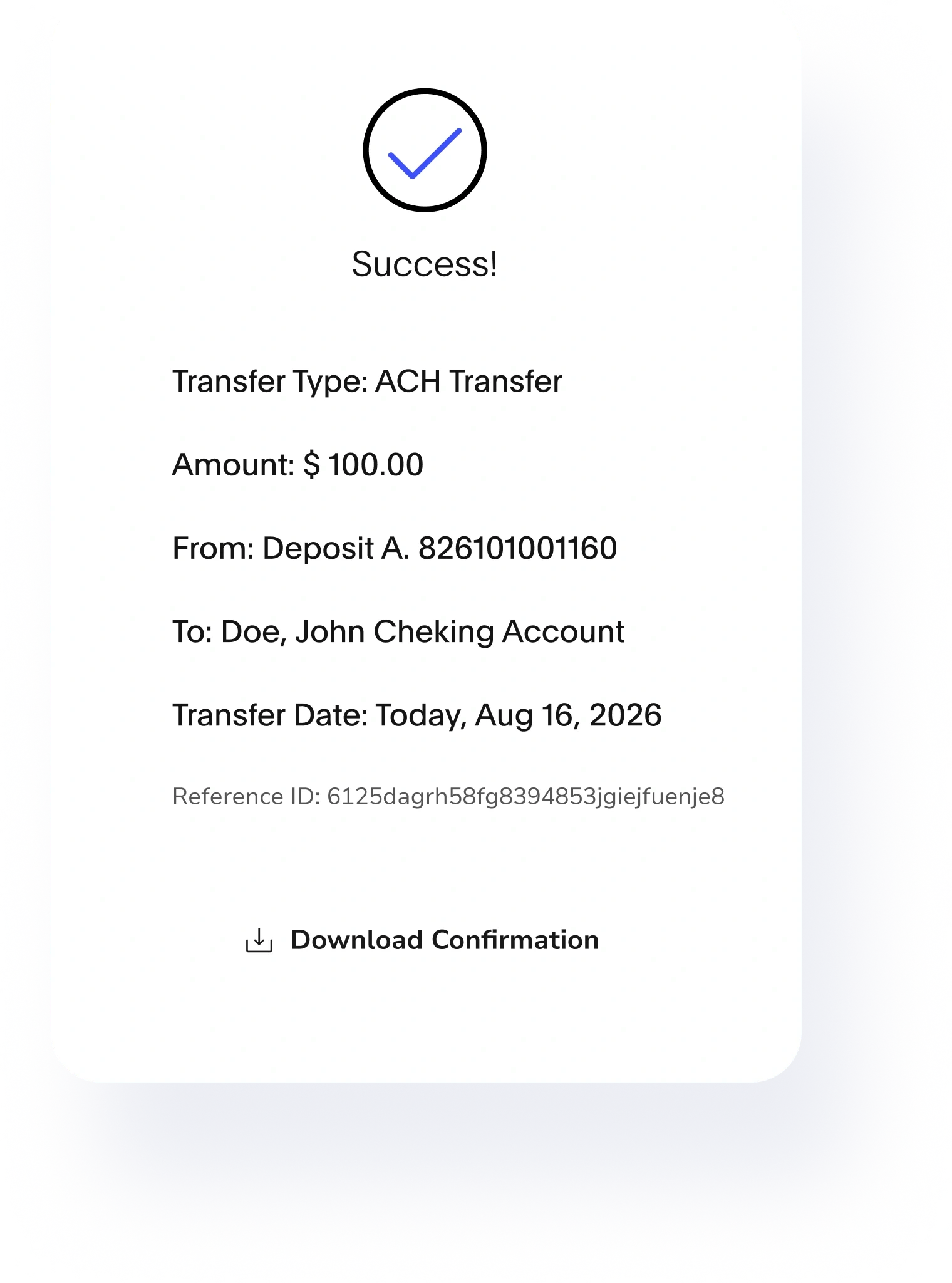

Offer robust front-end capabilities that span the management of accounts, transactions, payments, bill pay, contacts and more.

Tailored UX Journeys

Access a robust set of digital-first capabilities that support the needs of leading banks with a uniquely flexible platform, enabling them to build tailored journeys, dynamically — all while lowering costs to serve.

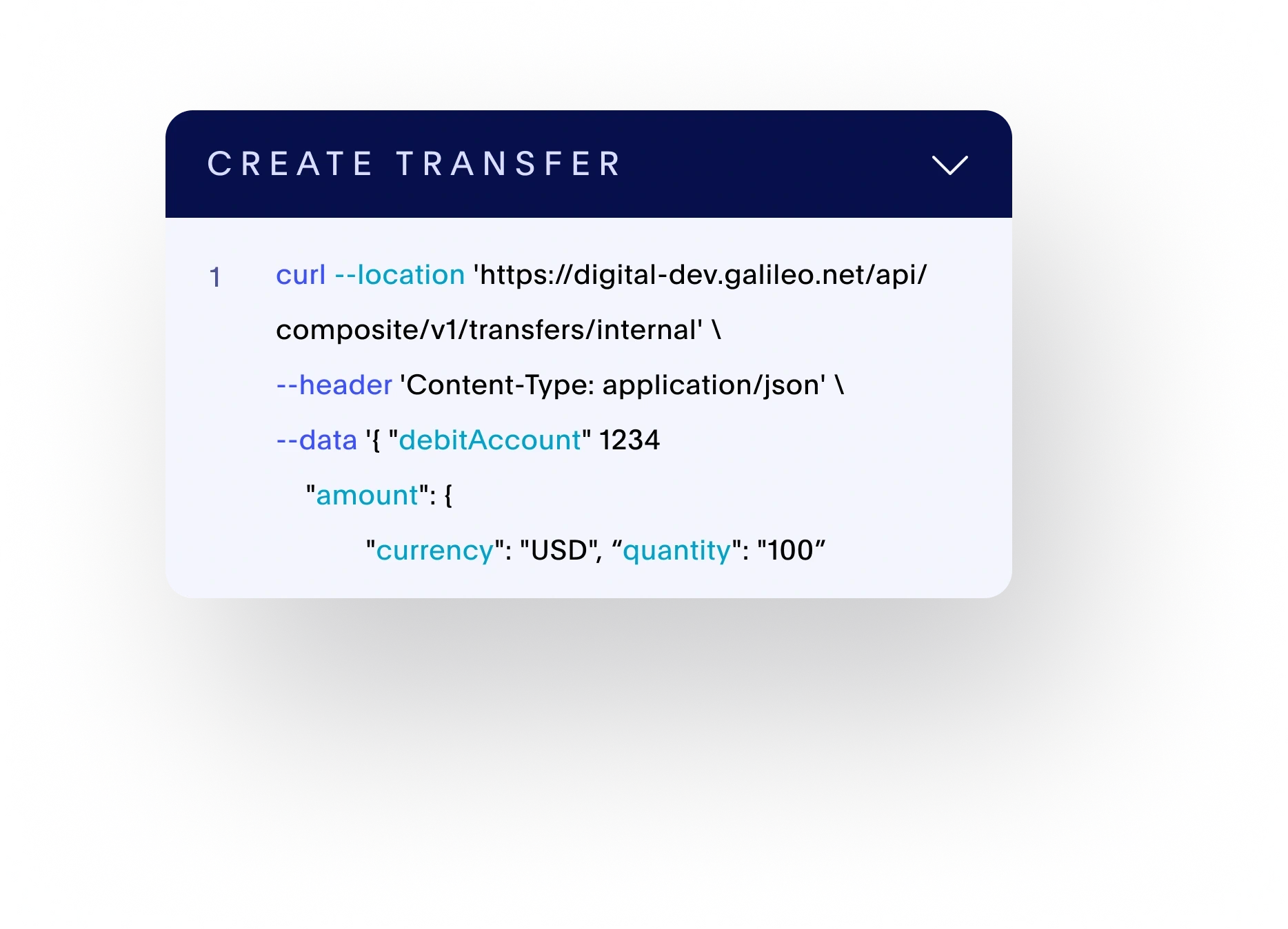

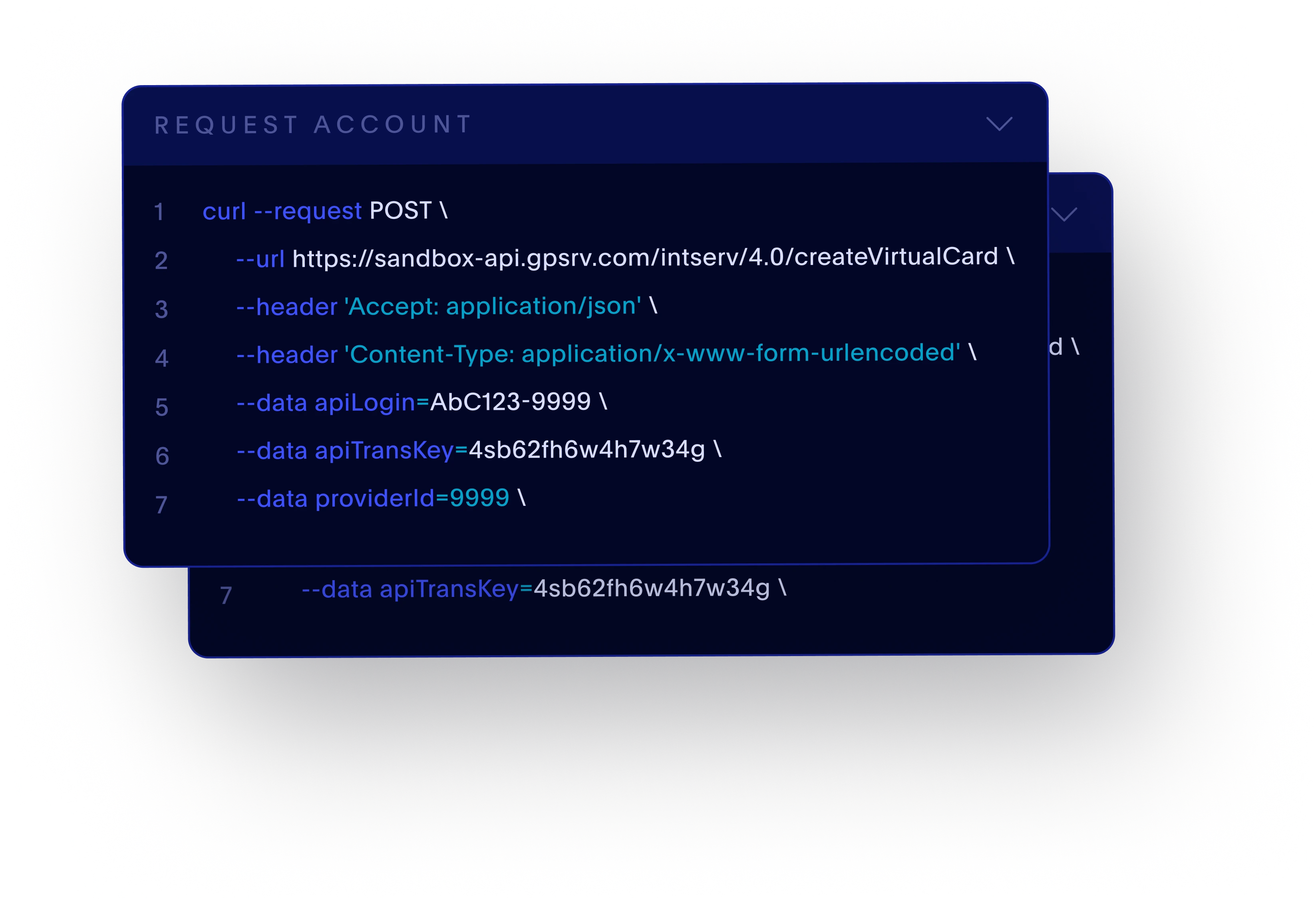

MICROservices-centric Model

Assemble in a modular way and customize services based on current needs and future innovations without overhauling the entire infrastructure.

modern deployment

Enable new versions to be released quickly, with a fully automated deployment process, including automated tests, security and code tests.

The Future of Banking

Are you ready to differentiate with Cyberbank Digital?

Contact us today and find out how we can support you in going beyond digital banking and become an integral part of your customers' lives.