É hora de que os pagamentos B2B alcancem os B2C

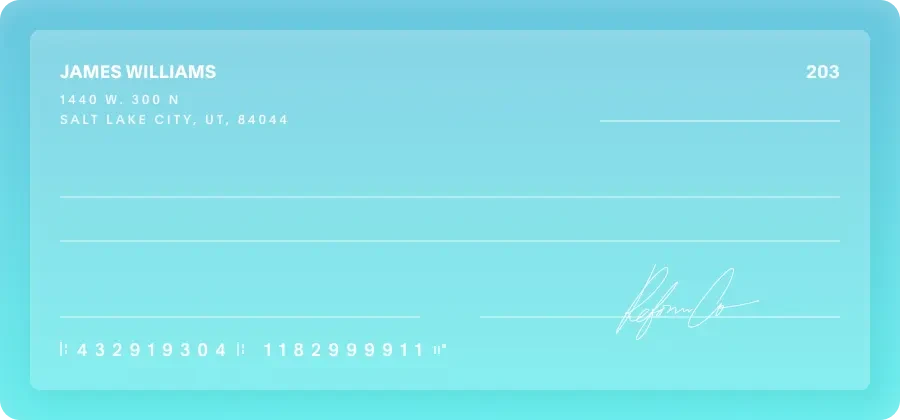

Hoje, 50% dos pagamentos B2B ainda são feitos por cheque, o que significa uma oportunidade de $200 trilhões para pagamentos B2B digitais na próxima década.

O futuro é digital. (O presente também é).

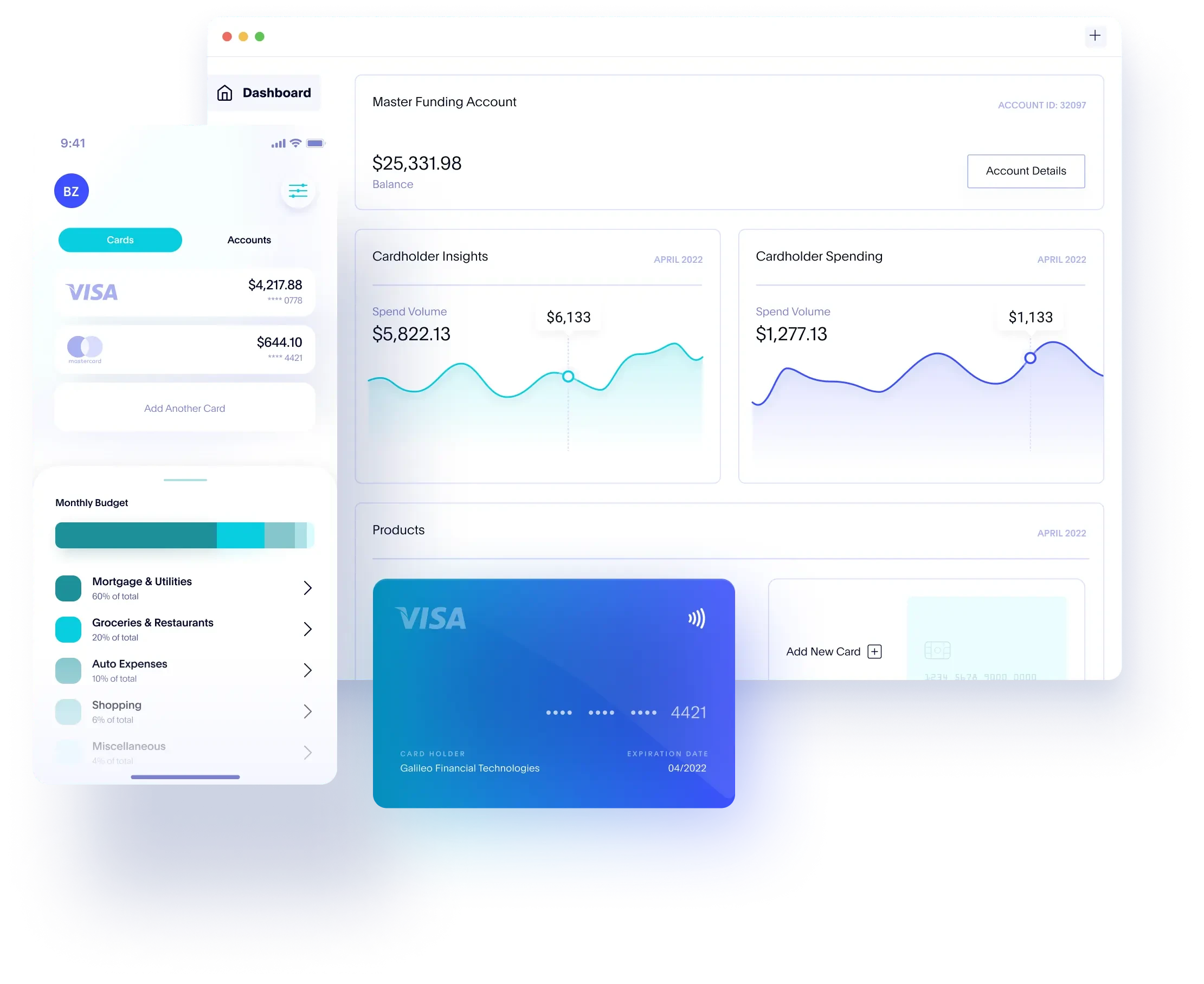

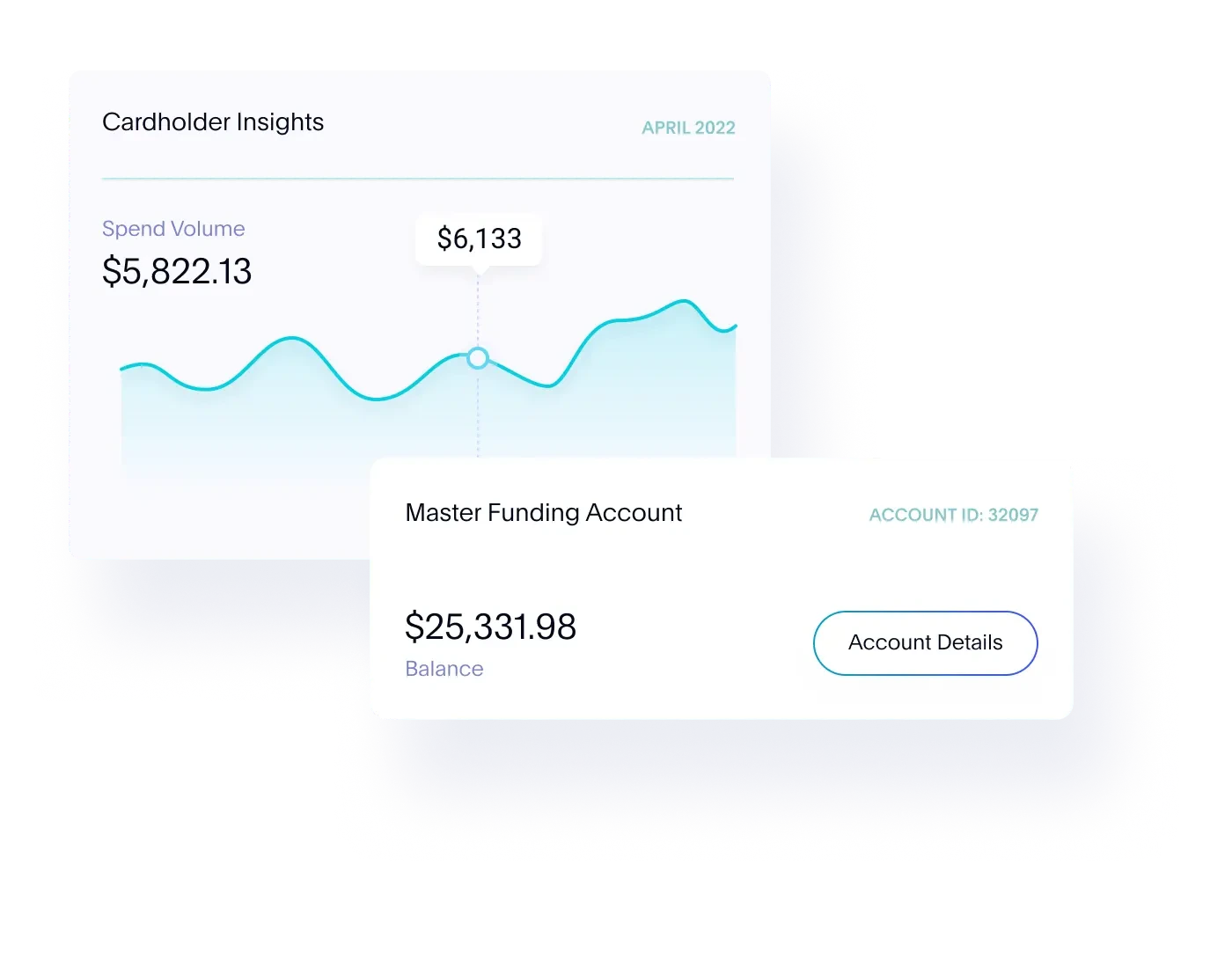

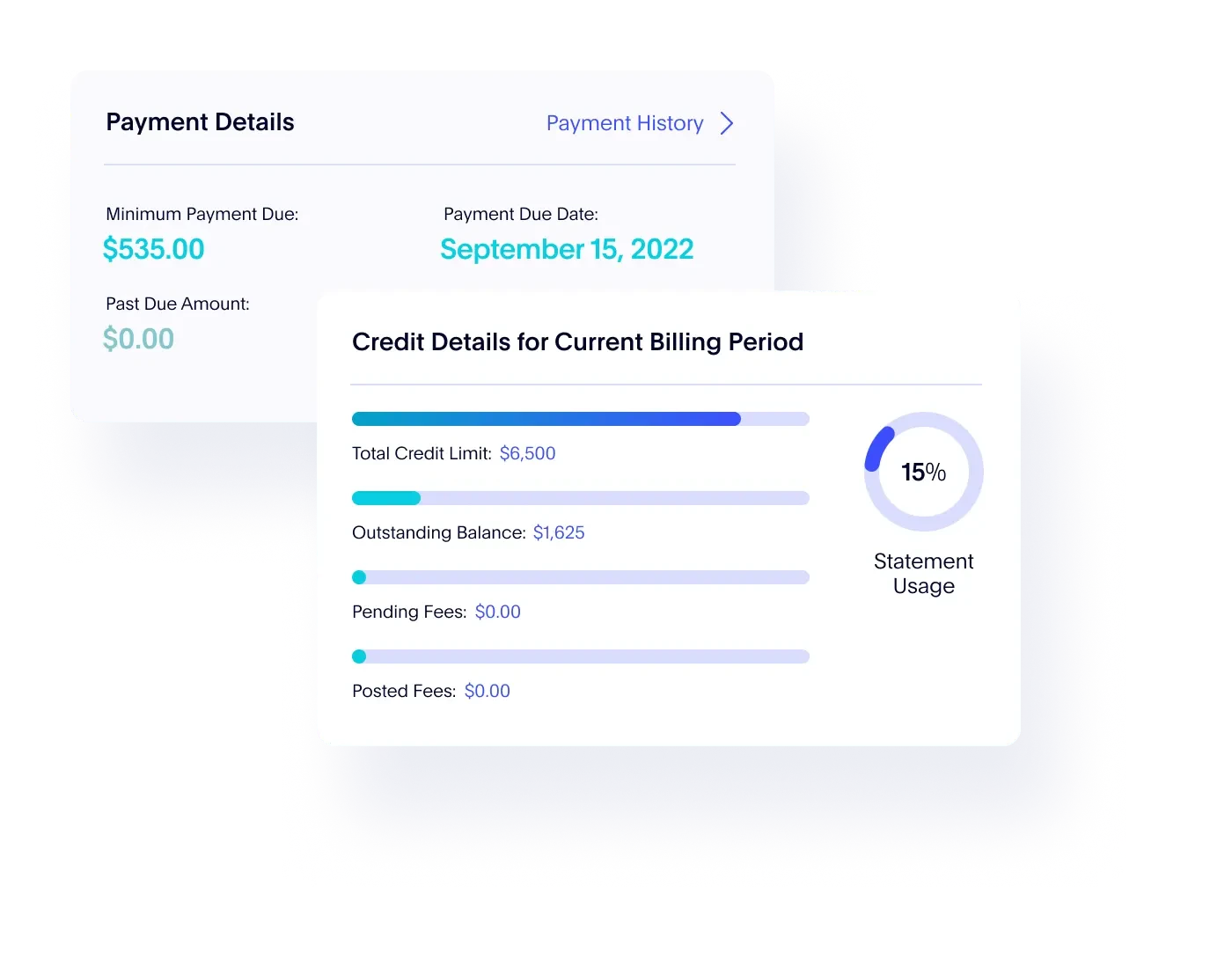

Clareza e controle para suas despesas comerciais.

Uma plataforma, experiências personalizadas.

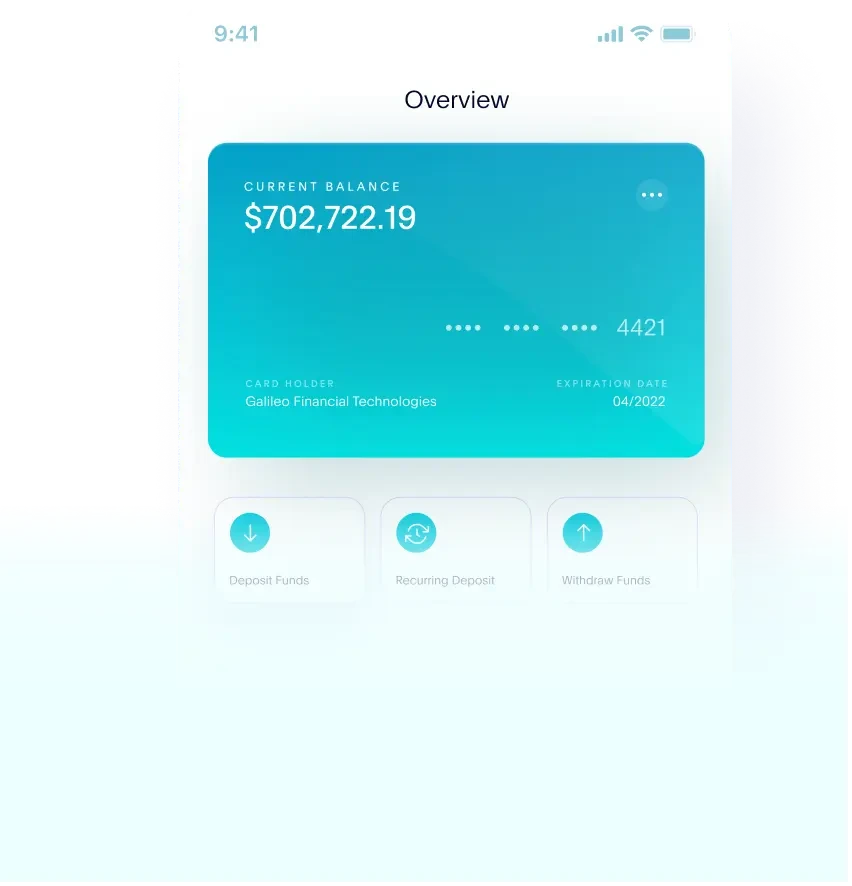

Melhora a experiência do seu cliente com uma infinidade de opções de depósito, como depósito direto, pagamento antecipado, arredondamento e capacidades de cheque especial.

Experiências transacionais contínuas e seguras são a base para o processamento de pagamentos e transferências de dinheiro hoje.

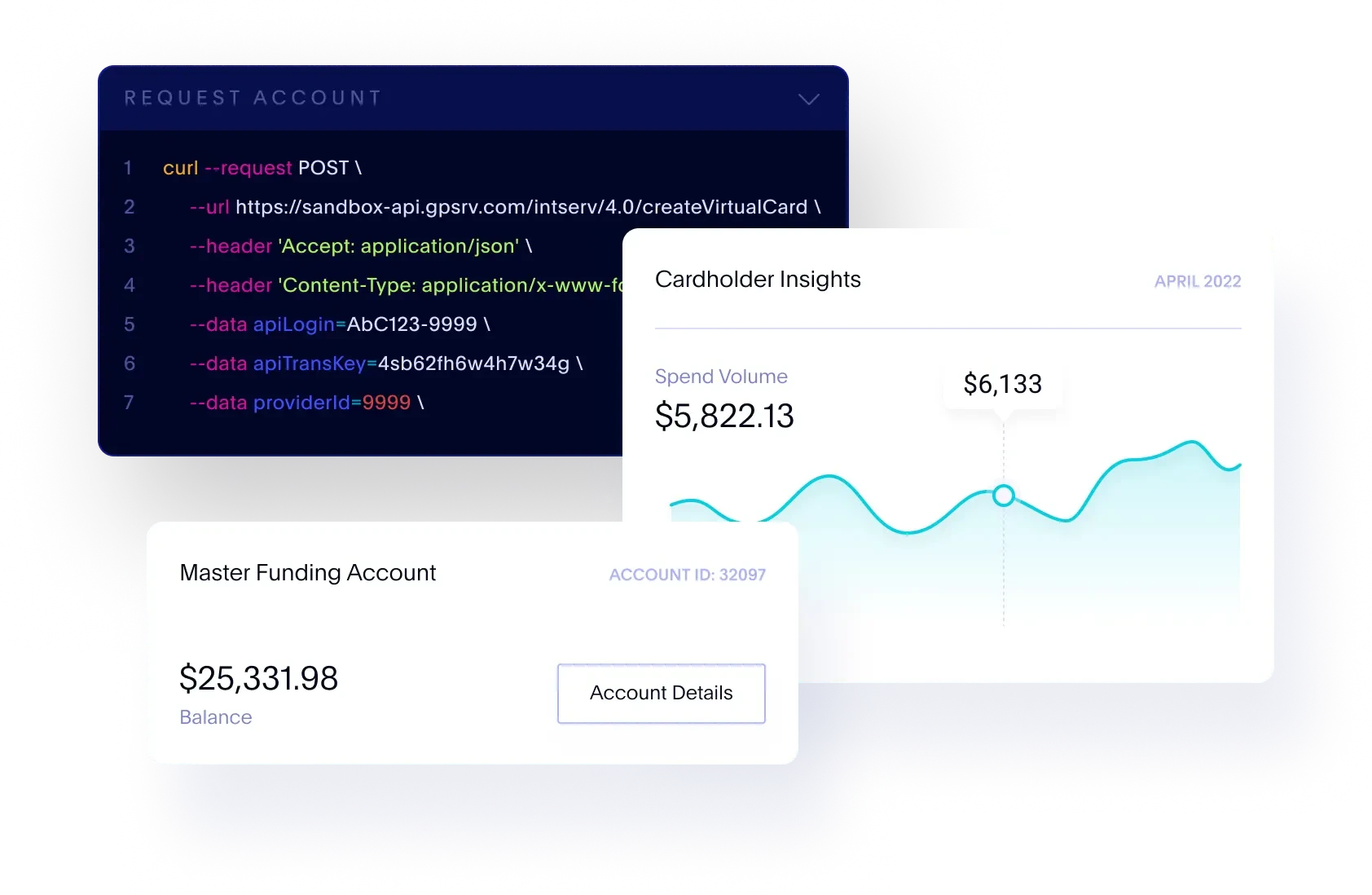

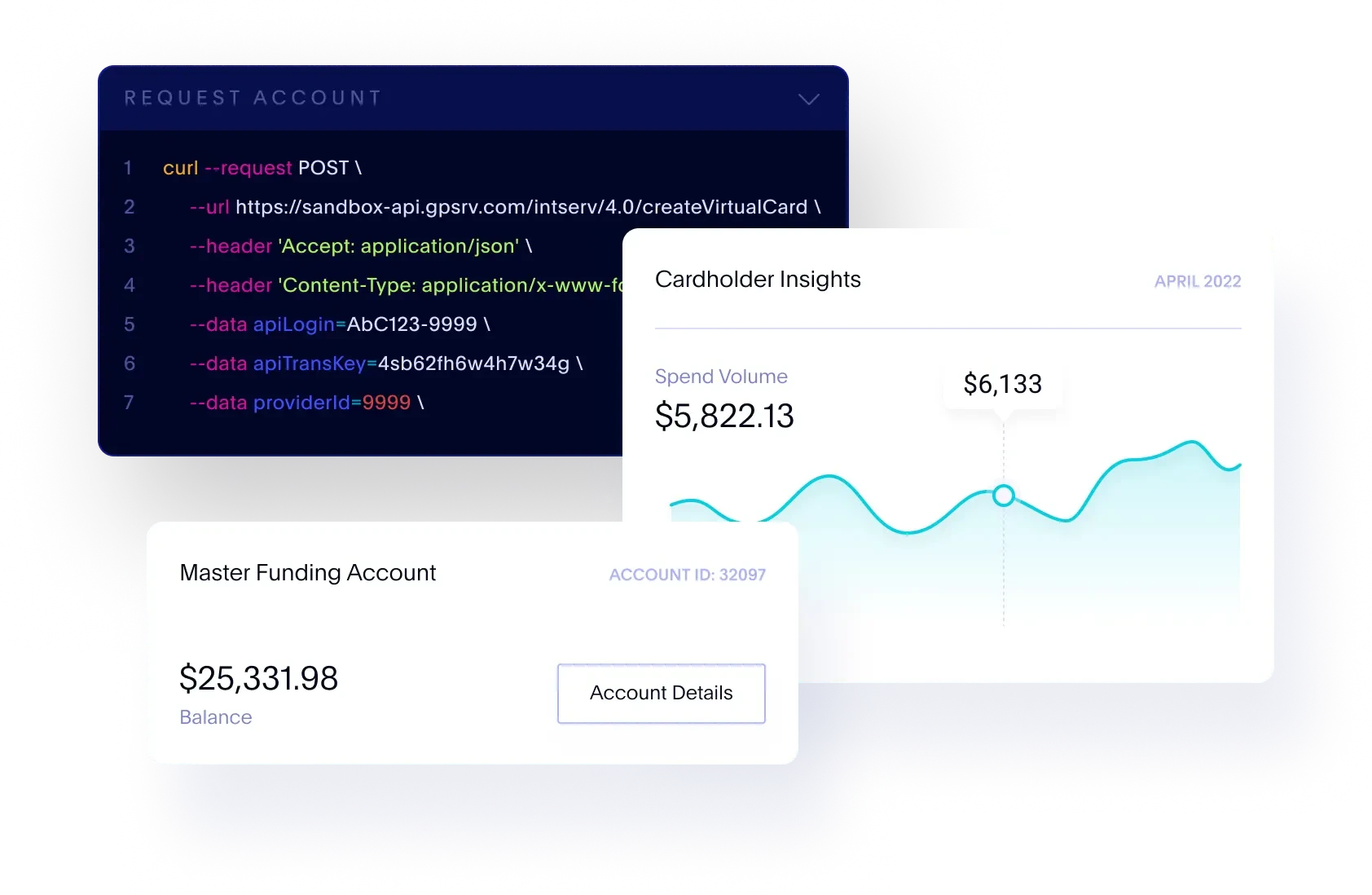

Seja para fornecer soluções de crédito mais rápidas e inovadoras - como cartões de crédito virtuais de uso único - ou serviços de empréstimo como empréstimos pessoais, empréstimos parcelados ou crédito garantido, a Galileo cobre você.

Experiências digitais primeiro para negócios.

DINHEIRO ENTRANDO

GERENCIAR DINHEIRO

DINHEIRO SAINDO

Teus clientes empresariais precisam de maior e mais flexível controle sobre suas receitas.

Learn how our solutions can elevate your offerings with a personalized self-guided demo of our APIs.

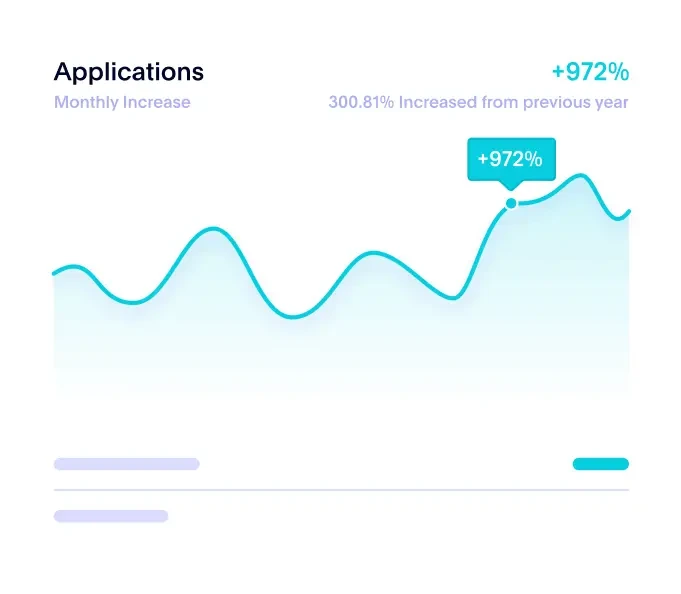

As preferências dos consumidores em mudança estão levando à inovação B2B

65%

OFERECER MÉTODOS B2B DIGITAIS

Porção de empresas que oferecem métodos de pagamento B2B digitais.

30%

SOLUÇÕES DE PAGAMENTO EFETIVAS

Percentual de empresas que acreditam que suas soluções atuais de pagamento B2B são 'muito' ou 'extremamente' eficazes em resolver pontos de fricção chave.

Chegue ao mercado rapidamente e escale.